QUESTION

Hello Mr.Old Man:

Here is my case. I hope you have time to review and share with me your opinion.

The beneficiary presented the documents to the confirming bank after expiry of the LC, the confirming bank sent the presenting bank a swift refusing to honour or negotiate the documents stating the following discrepancies:

- LC expired.

- Late remittance

And asked for the beneficiary’s agreement to the mentioned discrepancies and their authorization to send the documents to the issuing bank “for agreement ” or to state other instructions otherwise they will return the documents as per article 16 (e) of UCP.

The beneficiary authorized the confirming bank to send the documents to the issuing bank requesting the applicant to effect payment.

My questions are:

- What does sending the documents for agreement mean?

- What does late remittance discrepancy mean?

- What is the confirming bank’s liability in this case?

- Is the issuing bank liable to effect payment prior to release of the documents to the applicant or not? Noting that LC is available at sight .

In your opinion what is the best practice to ensure the beneficiary should do in case the documents are presented under the LC that expired?

Thank you for your time

Muna Najjar

—-

ANSWER

Hi Najjar,

Where an LC has expired, the issuing bank’s payment liability under the LC ceases, hence, it may reject and return the documents to the presenting bank or the beneficiary unless the applicant agrees to take up the documents to take delivery of the cargo.

Similarly, where a confirmed LC has expired, the confirming bank’s liability under the LC ceases, hence, it may reject and return the documents to the presenting bank or the beneficiary unless the beneficiary instructs the confirming bank to forward the documents to the issuing bank on approval basis. Upon receipt of the documents, the issuing bank would approach the applicant asking whether or not the applicant agrees to accept the documents presented after the expiry of the LC. If the applicant accepts the documents, the issuing bank can pay the bill amount after deducting the discrepancy fee.

Presenting the documents on approval basis also applies to the case where the presented documents contain other discrepancies.

Now, back to your specific case. I would like to answer as follows:

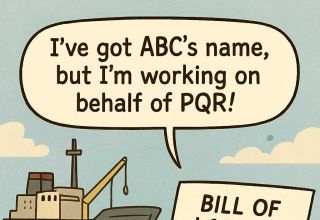

- Sending the documents to the issuing bank for agreement is to some extent the same as presenting the documents to the issuing bank on approval basis.

- In LC transactions there is no discrepancy called “late remittance”. Perhaps the confirming bank meant “late presentation”.

- As said, where the LC expired. the confirming bank’s liability ceases. In this case it is acting as a presenting bank only.

- As the documents are presented on approval basis, the issuing bank shall pay only when the applicant accepts the documents.

In my own opinion, where the L/C expired or where the documents contain discrepancies, the beneficiary may choose to present the documents on approval basis, especially when he knows for sure that the applicant will accept and take up the documents to take delivery of the cargo.

Please also refer to my similar Q&A:

https://mroldman.net/under-reserve-vs-on-approval-basis/

Best regards,

Mr. Old Man

Faisal Zaheer

December 5, 2023 at 8:57 pm

Hi old Man ,

my question is An issuing bank has identified discrepancies in a presentation of documents and provided a refusal notice to the presenter according to sub-article 16 (c) (iii) (b).

The issuing bank then receives a waiver of the discrepancies from the applicant.

Is the issuing bank now obliged to honour even though the applicant has insufficient funds?

please guide

Mr Old Man

December 6, 2023 at 8:47 pm

The issuing bank pays only when it receives a waiver from the applicant and AGREES TO ACCEPT IT. Therefore, if the applicant agrees to waive the discrepancies, the issuing bank can refuse to pay even when the applicant has enough funds.

Faisal Zaheer

December 7, 2023 at 2:24 pm

Always excited to see your new articles and the answers in easy English language you give by quoting references form ISBP

big fan of you Mr. old man , thanks for your reply.